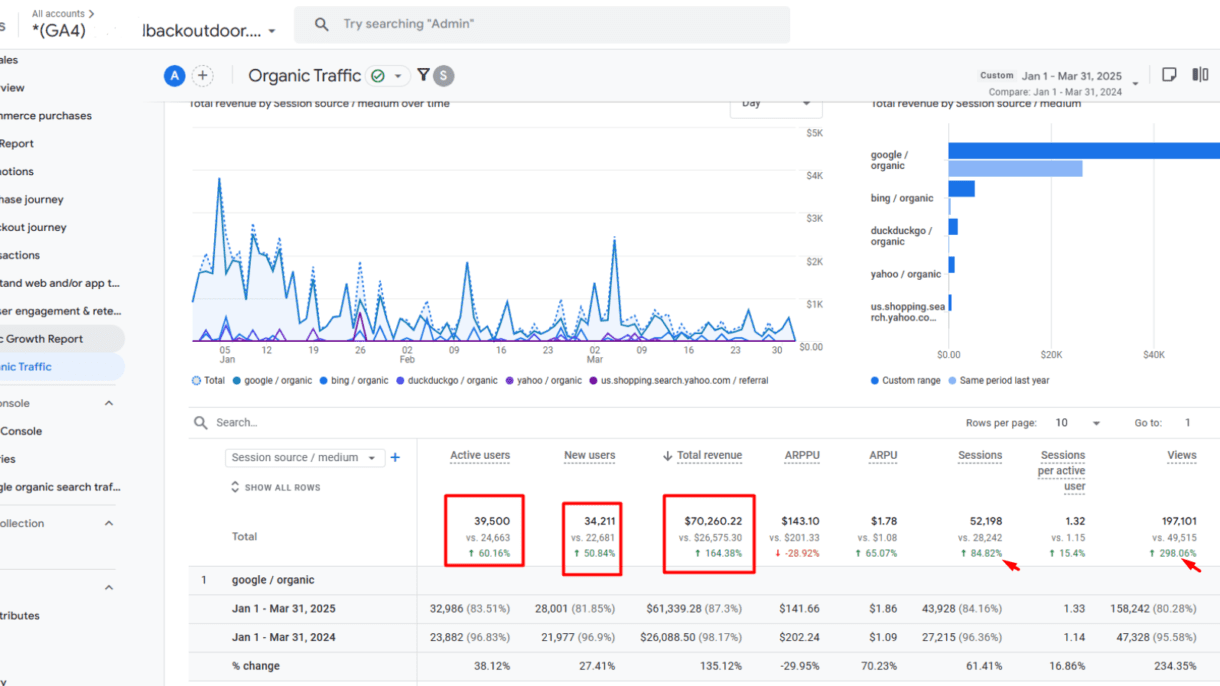

Drove +164% Organic Revenue Growth for Outdoor Gear Store via Technical SEO & UX Fixes

When an outdoor gear startup suddenly lost 71% of its first-page keyword rankings, its innovative trade-in model was in danger. Buyers couldn’t find products. Sellers had fewer reasons to list gear. Growth stalled.

But the real shock? The site’s downfall wasn’t from competition—it was from hidden technical traps quietly bleeding visibility.

Products Google couldn’t see. Schema errors burying high-value listings. 404-ridden pages. Crawl signals scattered in every direction.

We asked: What if fixing these invisible barriers could flip the entire growth story?

7 months later, the numbers spoke for themselves

Client Situation

The outdoor gear startup, which launched in 2019, built its business around a unique trade-in model: users could sell used outdoor gear for cash or space savings, while buyers could purchase high-quality, fairly used products at lower prices. This model reduced stocking costs and gave the platform a pricing advantage—a strong start toward unlocking a blue ocean.

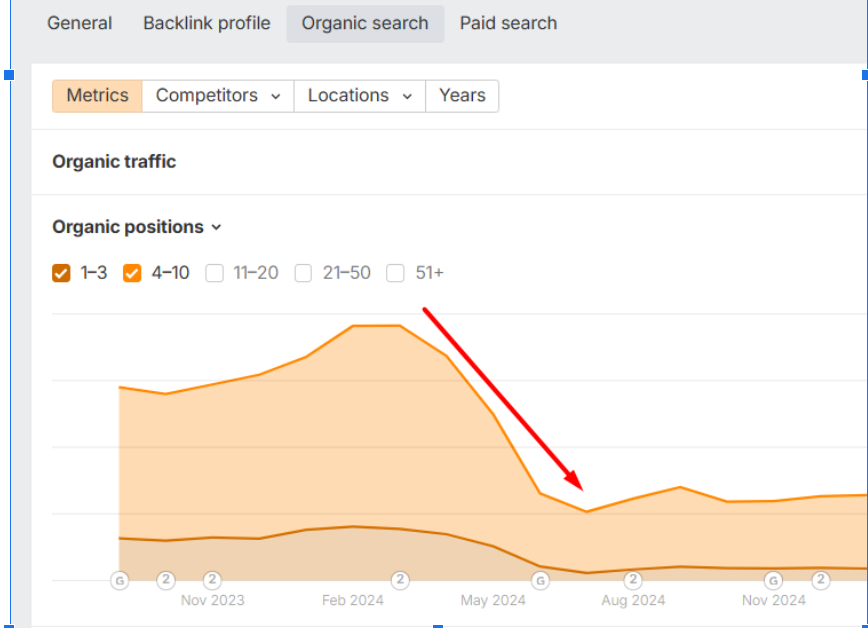

However, by mid-2024, the site faced serious SEO challenges. For example, First page keywords dropped by from 2678 in March 2024 to 772 by July of the same year – View Here and Here

These challenges threatened growth on both sides of the marketplace because

- Sellers needed to trade in gear to maintain a consistent inventory for the platform.

- Buyers needed to discover and purchase gear to monetize the platform.

When rankings dropped and revenue stagnated, we stepped in with a technical and UX-focused SEO strategy.

Findings and Resolution Tasks

To help the site overcome its marketing challenges and preserve its blue ocean advantage, we began with a deep technical and UX audit. This revealed several critical SEO issues:

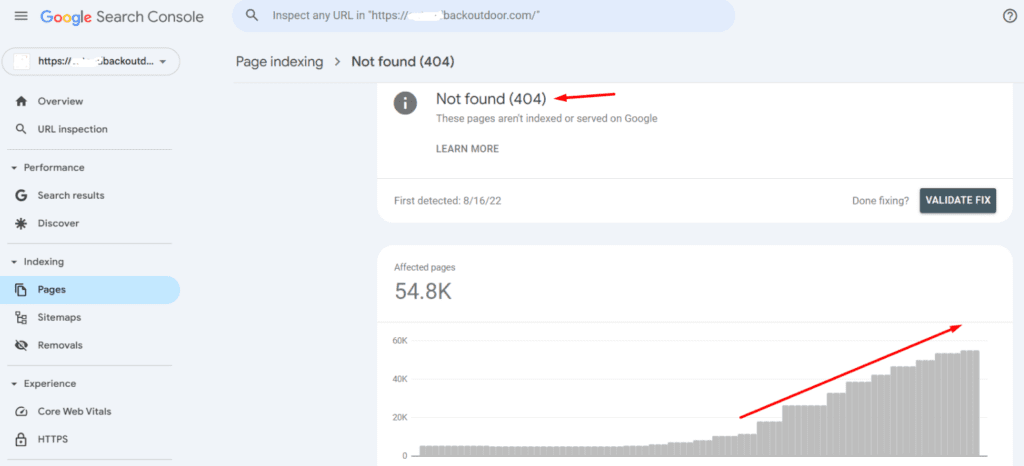

(a) Ranking instability from product page 404s

Because stock came from trade-ins, product availability was inconsistent.

This led to frequent 404s, broken internal links, keyword ranking losses on shopping surfaces, and lost revenue when in-demand items disappeared.

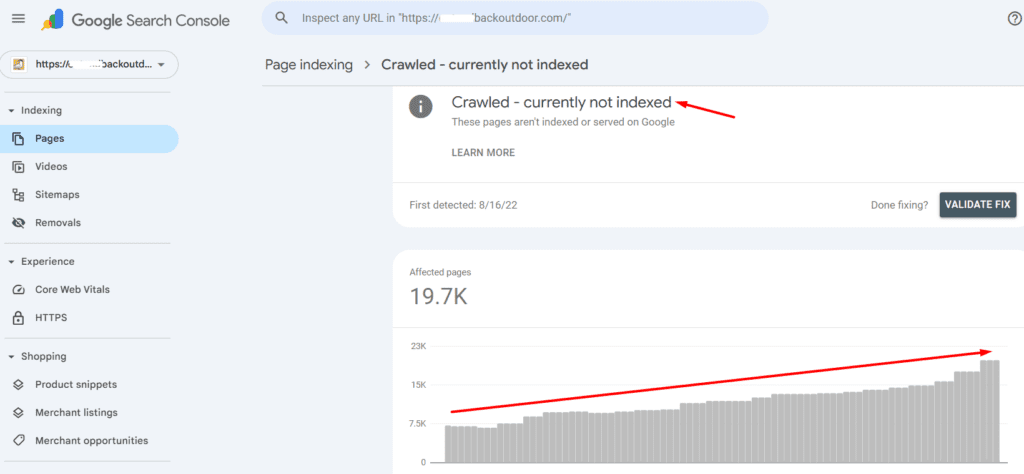

(b) Bloated site structure from filtering parameters

Many pages were discovered or crawled, but remained unindexed due to the large number of filter pages that were bloating the site size and muddying the crawl paths

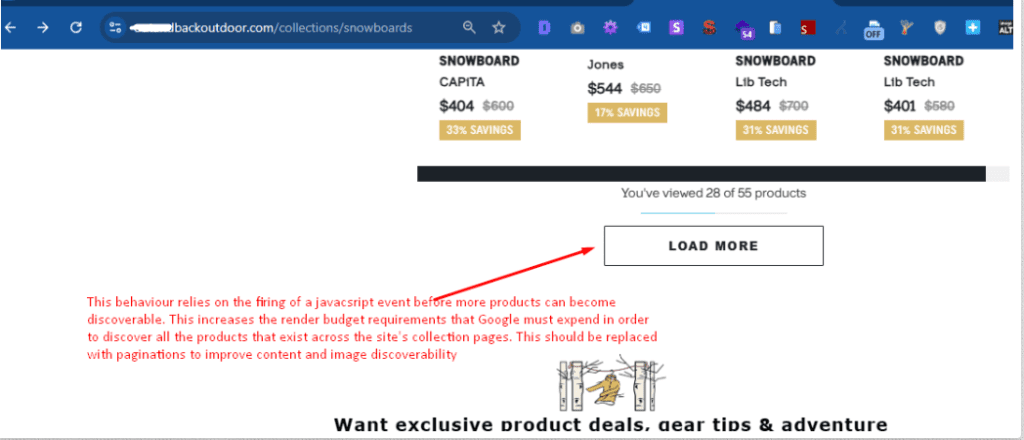

(c) The Use of “Load More” buttons instead of pagination

This setup caused important products to be hidden behind JavaScript rendering.

This caused orphan pages, low render ratios, and poor visibility on Google, Bing, and LLM crawlers.

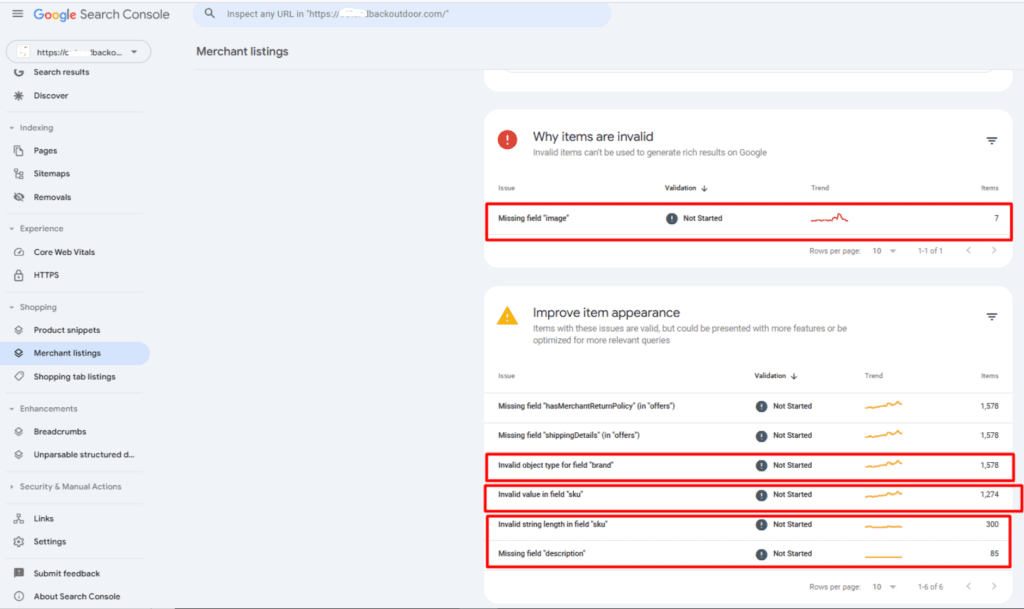

(d) The resolution of schema errors and missing attributes

These schema errors arising from invalid SKU values and brand types were impacting the site’s visibility in merchant listings and on shopping surfaces. Our resolution helped to reclaim lost ranking positions and improve organic impressions across the search ecosystem

(e) Crawl competition and inefficient linking

Multiple subdomains competed for attention with the main site.

Canonicalized product links on collections and broken crawl paths further diluted SEO signals.

(f) Internal content duplication and high compression ratio scores

Duplicate content risked keyword cannibalization and ongoing ranking instability.

These issues became the focus areas of our strategic interventions starting in August 2024.

Actions and Technical Interventions

Our technical initiatives were aimed at resolving the site’s technical drawbacks to severity and resolution impact. Hence, our strategy was organized in the following sequence

1. First Win: Making Products Visible Again: Our priority was ensuring that all products were easily discoverable. We replaced the clunky “Load More” setup with SEO-friendly pagination, so Google and users alike could see the full product range without relying on JavaScript. At the same time, we tackled the “crawled but not indexed” issue, unlocking new opportunities for keyword rankings and traffic growth.

2. Sharpening Schema & SERP Appearance: Next, we focused on how products showed up in search. We cleaned up schema errors, added missing elements like reviews and ratings, and rolled out Organization and FAQ schema across key pages. These changes not only fixed technical gaps but also made the site’s listings stand out more in search results and merchant feeds.

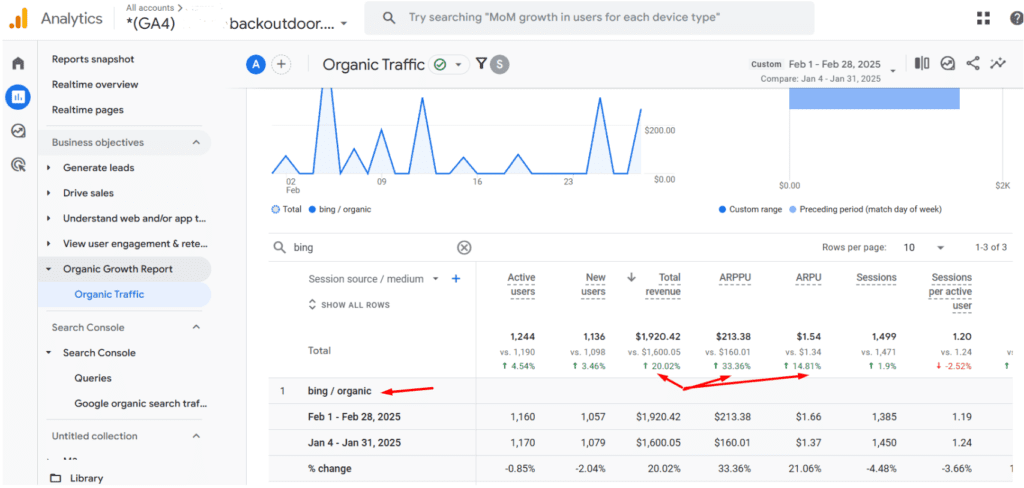

3. Expanding Reach Beyond Google: To diversify visibility, we helped the site qualify for Bing Shopping’s free listings by setting up a Microsoft Merchant Center store. This opened up an entirely new stream of exposure outside Google’s ecosystem.

4. Cleaning Up Links & Canonicals: We then went deep on site hygiene: fixing 404s, redirects, and server errors, while also resolving canonicalization issues on filtered and blog pages. Alongside this, we strengthened internal linking and added missing navigational paths—like “Gift Collections”—to create clearer, more logical user journeys.

5. Building Content & Improving Core Web Vitals

Finally, we enhanced on-page performance. Collection pages got fresh keyword-rich copy and FAQs to push “page two” rankings into the top 10. We also resolved duplication issues that were causing keyword cannibalization and optimized Core Web Vitals across key pages to make browsing smoother and faster.

Results

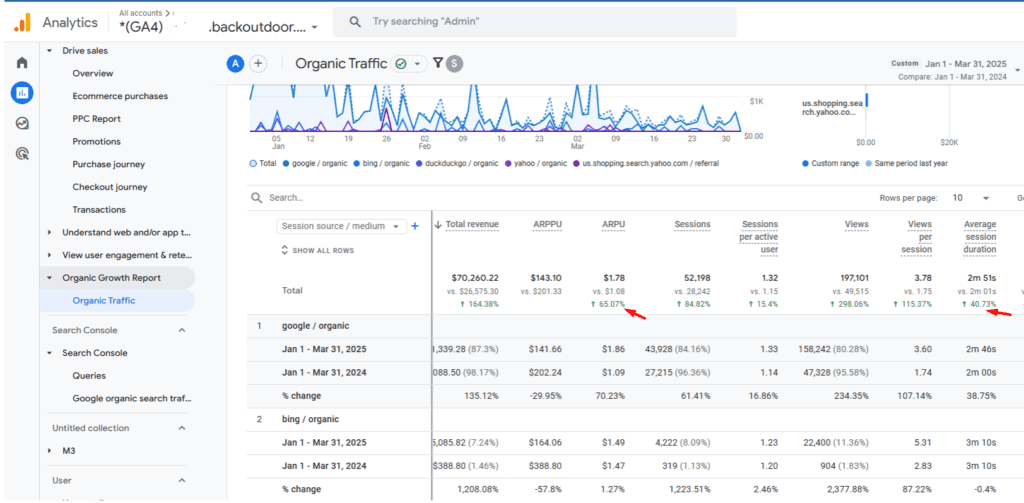

By February 2025, Bing revenue was being progressively amplified by the site’s free listing eligibility.

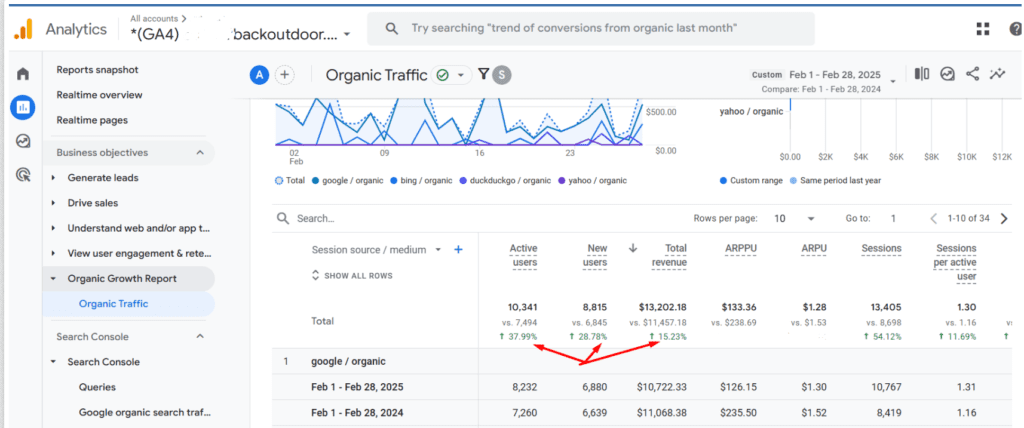

Organic revenue was also undergoing a steep incline due to the shopping visibility enhancements occasioned by the resolution of product schema and merchant listing errors.

To augment these gains, out-of-stock products were marked with sell on back order labels, to prevent product page 404s and maintain the keyword ranking gains those product pages had acquired

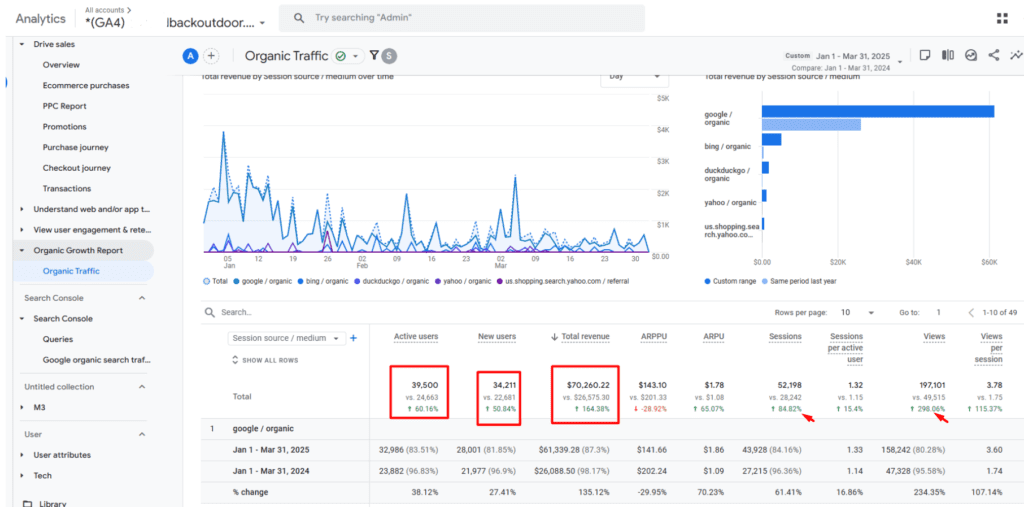

Within just 7 months (Aug 2024 – Mar 2025), the impact was clear.

- Organic revenue surged by 164%, from $26,575 in Q1 2024 to $70,260 in Q1 2025.

- Active users grew by 60% and new users by 50%, indicating stronger acquisition.

- Average revenue per user increased by 60%, while session duration improved by 40%, proving improved traffic quality and engagement.